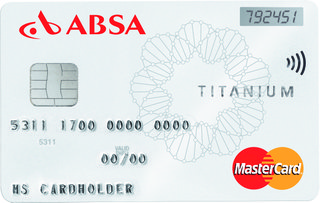

Indulge in the epitome of opulence with the Absa Mastercard Titanium Credit Card. Our in-depth exploration covers essential details, eligibility criteria, advantages, drawbacks, and the seamless application process for this exclusive credit card.

Discover a world of privileges and convenience as we unravel the unique features that make the Absa Mastercard Titanium Credit Card a beacon of luxury in the realm of financial sophistication.

Key Information about the Card

Tailored for discerning customers, the Mastercard Titanium Credit Card stands as an exclusive financial solution. Offering a suite of features, this card is crafted to meet the unique requirements of those seeking sophistication and premium services.

- Credit limit: The Absa Mastercard Titanium Credit Card presents an impressive credit limit, adeptly tailored to accommodate the diverse financial needs of customers. This substantial limit provides flexibility and empowers cardholders to manage their expenses with greater financial freedom.

- Qualification requirements: Securing the Absa Mastercard Titanium Credit Card necessitates meeting specific criteria. A minimum monthly net income is imperative; however, an alternative avenue involves presenting a term deposit certificate, offering applicants flexibility in meeting eligibility standards.

- Transaction capabilities: The Absa Mastercard Titanium Credit Card empowers users with versatile transaction capabilities. Enjoy the convenience and security of seamless transactions at Point of Sale (POS) locations, Automated Teller Machines (ATMs), and for secure E-commerce payments, providing a comprehensive and accessible financial experience.

- Interest-free period: Revel in financial flexibility with the Absa Mastercard Titanium Credit Card, offering an extended interest-free period of up to 50 days. This feature allows cardholders to manage their expenditures efficiently while enjoying a grace period without incurring interest charges.

Qualification Requirements

To qualify for the Absa Mastercard Titanium Credit Card, certain criteria must be met. This includes:

- A monthly net income of at least 40,000 Meticais or an equivalent term deposit as a guarantee.

- Required documents such as ID, proof of address, birth certificate or marriage certificate (if required), the latest payslip, and the last 3 months’ bank statements.

Please note that all documents must be in their original form, and the bank may request additional documents to process your application.

Benefits of the Absa Mastercard Titanium Credit Card

This exclusive credit card offers a variety of benefits that set it apart from others. These include:

- Flexible repayment options: Enjoy financial control with the Absa Mastercard Titanium Credit Card, offering a range of repayment flexibility. Cardholders can choose to settle between 10% and 100% of the outstanding amount as their monthly repayment, providing a tailored approach that aligns with individual financial preferences and circumstances.

- Special perks: Unlock a world of exclusive benefits with the Absa Mastercard Titanium Credit Card. Customers delight in remarkable discounts when acquiring goods or services, along with advantageous savings at Point of Sale (POS) locations within the extensive network of Absa partner businesses. This feature enhances the overall value proposition, making each transaction a rewarding experience for cardholders.

- International acceptance: The card is valid not only locally but also internationally within the VISA network, providing you with global access to your funds.

- Security: Benefit from convenience and 3D security when authenticating E-commerce transactions.

Cons and considerations

Despite the numerous advantages, the Absa Mastercard Titanium Credit Card also has some aspects to consider:

- Annual fees: Inquire about possible annual costs associated with card membership.

- Additional documents: There is a possibility that the bank may request additional documents or information for application processing.

How to Apply for the Absa Mastercard Titanium Credit Card

The application process for the Absa Mastercard Titanium Credit Card is straightforward. You can do this in various ways:

- Online application: Visit the official Absa website and fill out the online application.

- Branch visit: Go to a nearby Absa branch and apply for the card in person.

- Phone: Contact the bank by phone and follow the instructions to complete the application process.

Is the Card Worth It?

The Absa Mastercard Titanium Credit Card undoubtedly offers a myriad of benefits and exclusive perks. However, the decision on whether it’s worth your money depends on your individual needs, spending patterns, and financial goals.

Before deciding, we recommend carefully weighing the pros and cons and ensuring that the card aligns with your requirements. Overall, the Absa Mastercard Titanium Credit Card provides a top-notch experience for discerning customers who appreciate luxury, security, and financial flexibility.

If you’re in search of an exclusive credit card, this could be the right choice for you. Ready to elevate your banking experience with the exclusive? Discover unparalleled benefits and rewards tailored to your lifestyle. For more details and to apply, visit our website now and unlock a world of financial possibilities.