In the realm of premium credit cards, the American Express Platinum Credit Card stands tall, offering a plethora of exclusive benefits and privileges. Let’s delve into the key aspects of this prestigious card, from its qualifications to the pros and cons, helping you decide if it’s the right fit for your financial arsenal.

Key Information about the American Express Platinum Credit Card

The American Express Platinum Credit Card is renowned for its elevated status and exceptional offerings. It goes beyond being a simple financial tool, transforming into a gateway to luxury and convenience. Here’s a snapshot of what this card entails:

- Membership rewards program: One of the hallmarks of the Platinum Card is its Membership Rewards Program. Cardholders are not merely making purchases; they are accumulating points that can be redeemed for various rewards, ranging from travel perks to merchandise.

- Airport lounge access: Elevate your travel experience with exclusive access to airport lounges worldwide. The Platinum Card ensures that your pre-flight moments are marked by comfort and sophistication.

- Travel benefits: Enjoy a suite of travel-related advantages, including travel insurance coverage, concierge services, and special discounts on hotels and rental cars. The Platinum Card is designed to cater to the discerning traveler.

- Statement credits: The card often features statement credits for specific eligible purchases, such as airline fees or Uber rides. This unique feature enhances the overall value proposition for cardholders.

- Exclusive events: Platinum Card members gain access to a world of exclusive events, from concerts to curated experiences. It’s not just a credit card; it’s your ticket to a lifestyle marked by exclusivity.

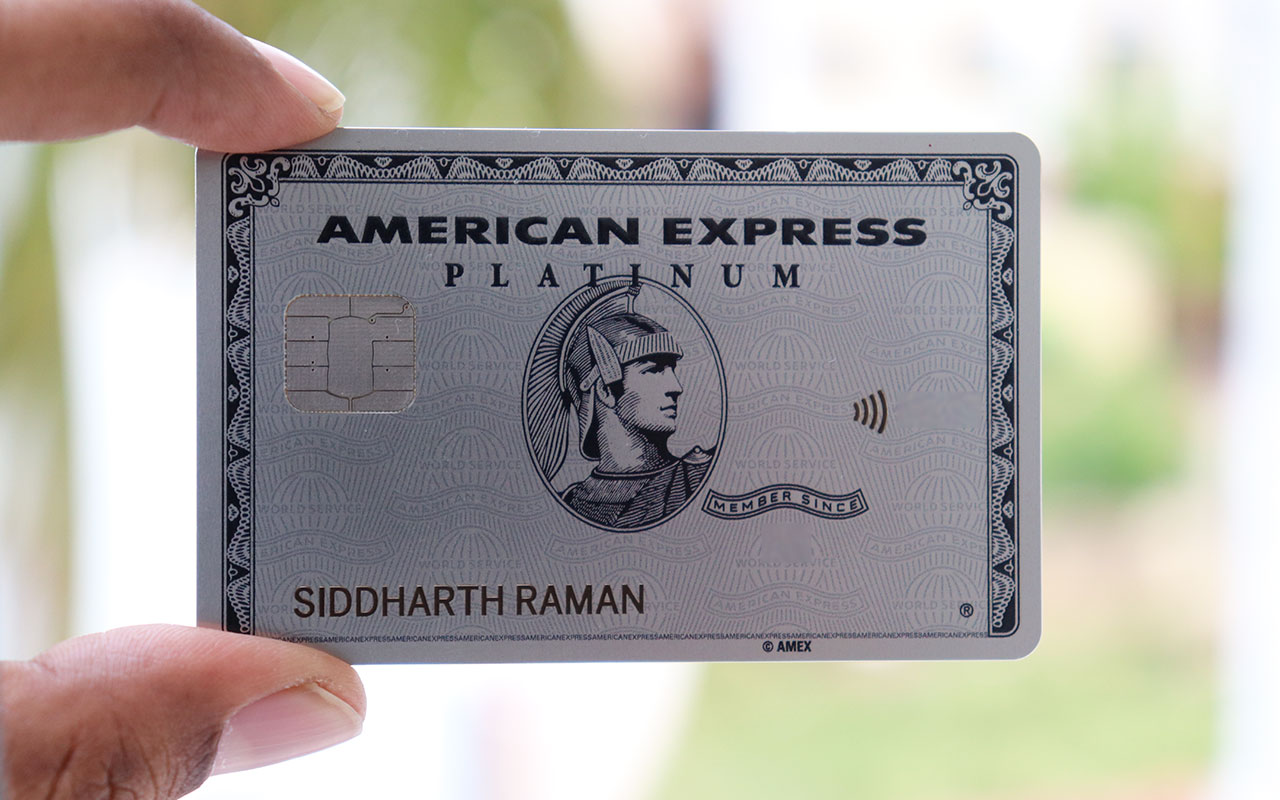

- Metal card design: The Platinum Card’s distinctive metal design isn’t just aesthetic; it symbolizes the weight and exclusivity associated with this premium financial instrument.

Qualification Requirements

While the allure of the American Express Platinum Credit Card is evident, gaining access to this exclusive club comes with certain qualification criteria. To be eligible for this card, applicants typically need to demonstrate a strong credit history and financial stability. The specifics can vary, so it’s advisable to check the latest requirements on the official American Express website.

Benefits that define excellence

Prospective cardholders are undoubtedly intrigued by the range of benefits offered by the American Express Platinum Credit Card. Here’s a closer look at some of the noteworthy advantages:

- Travel in style

- Membership rewards

- Statement credits

- Exclusive events

- Metal elegance

Considerations to keep in mind

While the American Express Platinum Credit Card offers a myriad of advantages, it’s essential to weigh the cons. Here are some factors to consider:

- Annual fee: The Platinum Card typically comes with a higher annual fee compared to standard credit cards. While the benefits may outweigh the cost for frequent travelers, individuals with different spending patterns should carefully evaluate the return on investment.

- Credit score requirement: Qualifying for the Platinum Card often necessitates a robust credit history. Individuals with lower credit scores may find it challenging to meet the eligibility criteria.

- Global acceptance: While American Express is widely accepted, it may not be as universally recognized as Visa or Mastercard. Before applying, consider the card’s acceptance in the regions you frequent.

- Reward redemption value: While the Membership Rewards Program is enticing, the value of points can vary depending on how they are redeemed. It’s crucial to understand the redemption options and assess their value to ensure optimal utilization of points.

How to Apply for the American Express Platinum Credit Card

Ready to embark on a journey of luxury and convenience? The application process for the American Express Platinum Credit Card is designed to be straightforward. Visit the official American Express website, navigate to the Platinum Card section, and follow the provided instructions. Be prepared to submit the necessary financial information and undergo a credit check.

Is the Platinum Card Worth It?

The ultimate question that looms is whether the American Express Platinum Credit Card is worth the investment. The answer hinges on your lifestyle, spending habits, and priorities.

For frequent travelers who value luxury and seamless experiences, the Platinum Card’s travel benefits and exclusive perks may justify the annual fee. If you’re a points-savvy individual who relishes the idea of redeeming rewards for travel, merchandise, or unique experiences, the Membership Rewards Program adds substantial value.

However, for individuals who prioritize a low annual fee or have specific preferences for card acceptance, it’s essential to weigh the benefits against the costs.

In conclusion, the American Express Platinum Credit Card is more than a financial tool; it’s a lifestyle enhancer. The decision to make it a part of your wallet should align with your financial goals and preferences.

Before taking the plunge, carefully evaluate the benefits, weigh the cons, and consider how well the card aligns with your unique lifestyle. It’s not just a credit card; it’s an invitation to a world of luxury and exclusivity.

For more details and to apply, visit our website now and unlock a world of financial possibilities.